Goldman Sachs Group (GS)

901.46

-3.09 (-0.34%)

NYSE · Last Trade: Feb 13th, 11:56 AM EST

Detailed Quote

| Previous Close | 904.55 |

|---|---|

| Open | 894.41 |

| Bid | 901.12 |

| Ask | 901.81 |

| Day's Range | 869.00 - 902.96 |

| 52 Week Range | 439.38 - 984.70 |

| Volume | 1,391,396 |

| Market Cap | 309.60B |

| PE Ratio (TTM) | 18.33 |

| EPS (TTM) | 49.2 |

| Dividend & Yield | 16.00 (1.77%) |

| 1 Month Average Volume | 2,636,879 |

Chart

About Goldman Sachs Group (GS)

Goldman Sachs Group is a leading global investment banking, securities, and investment management firm that provides a wide range of financial services to a diverse client base, including corporations, financial institutions, governments, and individuals. The company engages in various activities, including financial advisory services, underwriting of capital market transactions, asset management, and market making in securities and commodities. It is known for its expertise in mergers and acquisitions, risk management, and investment strategy, leveraging its extensive research capabilities and global reach to deliver innovative solutions in an ever-evolving financial landscape. Read More

News & Press Releases

In a high-stakes interview on February 13, 2026, Goldman Sachs (NYSE: GS) CEO David Solomon painted a remarkably optimistic picture of the American economy, describing the current macroeconomic setup as "quite good." Speaking on CNBC, Solomon pointed to a confluence of aggressive US deregulation and a historic surge in artificial

Via MarketMinute · February 13, 2026

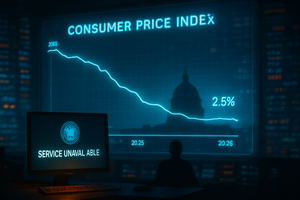

The U.S. Bureau of Labor Statistics delivered a long-awaited "Valentine’s Day eve" gift to the markets on Friday, February 13, 2026, reporting that consumer prices cooled more than expected in January. Headline inflation fell to 2.4% on a year-over-year basis, undercutting the 2.5% consensus forecast from

Via MarketMinute · February 13, 2026

During an interview with CNBC, Solomon said that while the U.S. has more latitude than others to run deficits, it still needs to bring them under control.

Via Stocktwits · February 13, 2026

The Dow Jones Industrial Average endured a chilling session this Friday, February 13, 2026, dropping 267.77 points, or 0.54%, to close at 49,184.21. The slide marked the second consecutive day of losses for the blue-chip index, following a more severe 669-point tumble on Thursday. What began

Via MarketMinute · February 13, 2026

As of mid-February 2026, the initial euphoria that surrounded the "Generative AI" boom of 2023 and 2024 has curdled into a structural "AI Anxiety" among the world's legacy technology giants. No longer is the market satisfied with promises of future productivity; investors are now demanding immediate returns on massive capital

Via MarketMinute · February 13, 2026

The U.S. financial landscape shifted decisively on February 13, 2026, as the Bureau of Labor Statistics released a Consumer Price Index (CPI) report that showed inflation cooling more rapidly than market analysts had anticipated. The headline January CPI rose at an annual rate of 2.4%, a notable deceleration

Via MarketMinute · February 13, 2026

Kathryn Ruemmler, the top legal officer at Goldman Sachs, will leave her role in June.

Via Benzinga · February 13, 2026

The global financial landscape underwent a seismic shift this month as the appointment of Kevin Warsh as the next Chair of the Federal Reserve sent shockwaves through the precious metals and currency markets. In a move that market participants are calling the "Warsh Shock," the announcement of a transition toward

Via MarketMinute · February 13, 2026

Wall Street expects another good year for the S&P 500 despite economic uncertainty created by President Trump's tariffs.

Via The Motley Fool · February 13, 2026

Shares in this computer memory specialist have soared over the last few months. But what comes next?

Via The Motley Fool · February 12, 2026

The U.S. labor market is facing a moment of profound reckoning as new data reveals that the economic engine of 2025 was far more sluggish than previously reported. On February 6, 2026, the Bureau of Labor Statistics (BLS) released its annual benchmark revisions, striking a devastating blow to the

Via MarketMinute · February 12, 2026

Bank of America (NYSE:BAC) has released its highly anticipated 2026 M&A Outlook, signaling a transformative shift in the global deal-making landscape. After years of cautious maneuvering and high interest rates, the bank’s Global Corporate & Investment Banking (GCIB) division characterizes 2026 as a "Powering Up" year. The report

Via MarketMinute · February 12, 2026

Following the release of a robust January jobs report that exceeded all Wall Street expectations, President Donald Trump has reignited his aggressive campaign against current Federal Reserve policy, calling for the United States to implement the “lowest interest rates in the world.” The President’s remarks, punctuated by a celebratory

Via MarketMinute · February 12, 2026

The financial world experienced a seismic shift on January 30, 2026, when President Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. This move, long-telegraphed by the administration but still jarring to global markets, marks the beginning of what analysts are calling the

Via MarketMinute · February 12, 2026

The U.S. labor market just delivered a thunderclap that has reverberated from the halls of the Federal Reserve to the trading floors of Wall Street. In a stunning reversal of the "cooling" narrative that dominated the final months of 2025, the January jobs report released this morning revealed that

Via MarketMinute · February 12, 2026

In a year when OpenAI, Anthropic, and SpaceX could all go public, this IPO-focused fund deserves a look.

Via The Motley Fool · February 12, 2026

XRP (CRYPTO: XRP) has gained 9% over the past seven days, outperforming much of the broader crypto market, as institutional developments and ecosystem upgrades boosted

Via Benzinga · February 12, 2026

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

As the first quarter of 2026 unfolds, the technology sector is asserting its dominance with a vigor that has caught even the most optimistic market spectators by surprise. Following a two-year period characterized by what analysts described as a "necessary digestion" of the explosive gains from the early 2020s, the

Via MarketMinute · February 12, 2026

As the global economy stabilizes into a period of disinflationary growth, Goldman Sachs (NYSE: GS) has released a robust 2026 stock market outlook, forecasting a 12% total return for the S&P 500. This optimistic projection, which places the index target between 7,200 and 7,600 by year-end, suggests

Via MarketMinute · February 12, 2026

Via Benzinga · February 12, 2026

The financial world witnessed a watershed moment on January 28, 2026, as the S&P 500 index breached the 7,000-point threshold for the first time in history. This milestone, coming just fourteen months after the index crossed the 6,000 mark in November 2024, underscores the relentless momentum of

Via MarketMinute · February 12, 2026

The financial markets were sent into a tailspin on Thursday as S&P Global (NYSE: SPGI) saw its shares slump by nearly 10%, marking one of its steepest single-day declines in recent years. The sell-off was ignited by the company’s release of its 2026 profit forecast, which fell significantly

Via MarketMinute · February 12, 2026

Via MarketBeat · February 12, 2026

As of February 12, 2026, CBRE Group (NYSE: CBRE) stands at a critical crossroads. As the world’s largest commercial real estate (CRE) services and investment firm, it has long been the primary bellwether for global property markets. Today, however, the company is navigating a complex transition. While the firm just reported record-breaking earnings for fiscal [...]

Via Finterra · February 12, 2026