News

Before claiming Social Security benefits, make sure you've taken these steps.

Via The Motley Fool · February 11, 2026

There's much more to the story than new customers and revenue growth.

Via The Motley Fool · February 11, 2026

Various studies agree on one best age for most -- but it's not the best age for everyone.

Via The Motley Fool · February 11, 2026

ETF outflows and inactive ‘whales’ signaled market caution, while a proposed market structure bill was seen as a potential future catalyst.

Via Stocktwits · February 11, 2026

The Definitive Guide to UAE Premium and Relationship Banking: Eligibility, Costs, and Material Value

Picture yourself standing in line at a UAE bank branch on a Thursday afternoon. The queue winds around velvet ropes, and you've been waiting twenty minutes to submit a credit card application. The bank’s teller looks at your application, makes some stamps on the application form, and then tells you it will take three to four business days for processing, and it might take longer if more KYC documents are needed. Still standing there with the bank’s teller, you notice a different client in a different section of the banking hall labelled executive banking. He is seated on a posh leather sofa and is greeted by the bank’s relationship manager, who hands him a cup of coffee. This guy is applying for the same credit card. Within fifteen minutes, he’s looking over preliminary approval terms while having coffee. By tomorrow, the card will arrive by courier.

Via PulseBulletin.com · February 11, 2026

The digital bank has incredible long-term opportunities.

Via The Motley Fool · February 11, 2026

Global markets open with a risk-cautious tone as softer US data accelerates a dovish Fed repricing and dollar weakness.

Via Talk Markets · February 11, 2026

Finding the best personal loans with low interest rates can significantly reduce the total cost of borrowing. In 2026, personal loan APRs vary widely — starting around 6.5%–8% APR for top-tier borrowers and climbing above 30% APR for weaker credit profiles . Source : Bankrate personal loan rate surveys and Experian Consumer Credit Review data (2025–2026), which show minimum advertised APRs in the mid-single-digits for excellent credit and maximum APRs exceeding 30% for subprime borrowers.

Via BusinesNews Wire · February 11, 2026

China’s Treasury pullback sparked risk-off fears in crypto, as Fed rate cuts, tensions in Japan, and Ethereum buying shaped the outlook.

Via Stocktwits · February 11, 2026

Regal Rexnord’s fourth quarter drew a positive market response, despite missing Wall Street’s revenue expectations. Management pointed to robust order growth across its data center, automation, and aerospace segments as key drivers behind the quarter’s performance. CEO Louis Pinkham credited the company’s large e-Pod solution wins in the data center market and a backlog up 50% year over year for the strong finish, stating, "Our team delivered solid fourth quarter performance, ending the year on a high note." The company also cited disciplined execution and ongoing synergy realization as supporting factors.

Via StockStory · February 11, 2026

Crown Holdings delivered fourth-quarter results that surpassed Wall Street's expectations, driven by steady growth in global beverage can volumes and robust execution in its European beverage operations. Management pointed to a 3% increase in beverage can units, supported by strong demand in Europe and resilient performance in North America, as key contributors. CEO Timothy Donahue highlighted, “European beverage volumes increased 10% in the fourth quarter with shipments remaining strong across the Mediterranean and The Gulf States,” offsetting softer trends in Transit Packaging and the Brazil beverage market. The company also benefited from improved food can demand within its North American tinplate business.

Via StockStory · February 11, 2026

Mueller Water Products delivered better-than-expected Q4 results, driven by higher pricing across most product lines and continued manufacturing efficiencies. Management credited the performance to operational improvements, especially from the transition to the new brass foundry, which offset the impact of elevated tariffs and persistent inflationary pressures. President and Chief Operating Officer Paul McAndrew emphasized that strong end-market demand for municipal repair and specialty valves helped overcome weaker residential construction activity, stating, “Manufacturing efficiencies more than offset the impact from higher tariffs and inflationary pressures, driving year-over-year gross margin expansion.”

Via StockStory · February 11, 2026

New analysis argues that tariffs may not trigger material inflation, as currency adjustments and supply chain shifts act as offsets. This contrarian view suggests the Phillips Curve and fiscal policy remain the primary drivers of 2026 prices.

Via Talk Markets · February 11, 2026

January CPI inflation slowed to 0.2% year-on-year as food prices fell sharply to -0.7% YoY due to Lunar New Year impacted base effects, and should flip in February. We expect CPI inflation is still on track to recover overall in 2026

Via Talk Markets · February 10, 2026

Investor focus shifted to Wednesday’s U.S. jobs report, wage data, Fed remarks, and the federal budget release.

Via Stocktwits · February 10, 2026

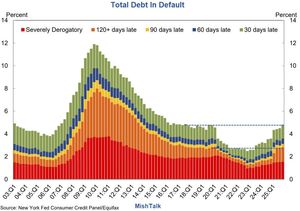

It will come as a surprise to exactly nobody that the Fed's latest quarterly Household Debt and Credit report reported total household debt balances increased by $191 billion in the 2025 Q4, a 1% rise from 2025 Q3, to a new all-time high.

Via Talk Markets · February 10, 2026

Robinhood (HOOD) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 10, 2026

CMCL’s low payout ratio, hedged $3,500‑floor gold pricing, and 56% implied upside from its lone “Strong Buy” target make it an attractive small‑cap dividend grower for 2026.

Via Barchart.com · February 10, 2026

MasterBrand (MBC) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 10, 2026

This little-known stock isn't even on the S&P 500, but its dividend growth leaves the index in the dust.

Via The Motley Fool · February 10, 2026

EUR/USD pulls back as hawkish Fed rhetoric offsets softer US economic data.

Via Talk Markets · February 10, 2026

Credit card balances 90+days delinquent is the highest since 2011.

Via Talk Markets · February 10, 2026

Credit plays a central role in modern financial systems, yet it remains one of the most misunderstood tools available to individuals and small business owners. According to financial literacy professionals such as Charisma Shepherd, credit is often approached with fear rather than understanding, despite its significant influence on long-term financial opportunity and access to capital. This misunderstanding can lead people to avoid credit entirely or misuse it, limiting their financial flexibility over time.

Via AB Newswire · February 10, 2026

Salt Lake City, Utah - America’s flood maps are falling behind a rapidly growing reality: flood disasters are escalating nationwide, exposing millions of households to rising risk. New national data from NOAA’s National Centers for Environmental Information (NCEI) shows a sharp escalation in the number of billion-dollar weather and climate disasters across the United States from 1980 to 2024. This includes the most common natural disaster, flooding.

Via AB Newswire · February 10, 2026

The fact that few others like it right now only adds to its potential upside.

Via The Motley Fool · February 10, 2026