Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

The global financial landscape was upended on February 6, 2026, as the precious metals market witnessed a "6-sigma" volatility event that defied centuries of historical correlation. In a session characterized by pure atmospheric chaos, silver prices skyrocketed to an unprecedented $78 per ounce, while gold, the traditional safe-haven anchor, suffered

Via MarketMinute · February 6, 2026

In a stunning display of market resilience, "crypto proxy" stocks led a massive broad-based rally on February 6, 2026, as digital asset prices staged a dramatic "V-shaped" recovery. Leading the charge, Robinhood Markets, Inc. (NASDAQ: HOOD) saw its shares climb by more than 14%, while Coinbase Global, Inc. (NASDAQ: COIN)

Via MarketMinute · February 6, 2026

Evercore (NYSE: EVR), a powerhouse in the independent advisory sector, released its fourth-quarter and full-year 2025 earnings this week, providing the most definitive evidence yet of a "V-shaped" recovery in global mergers and acquisitions. Following two years of relative stagnation, the firm reported record-breaking revenue and an unprecedented backlog of

Via MarketMinute · February 6, 2026

In a staggering blow to the cosmetics industry, Coty Inc. (NYSE: COTY) saw its shares retreat by 16% today, February 6, 2026, marking the company’s steepest single-day decline in years. The sell-off followed a disappointing second-quarter fiscal 2026 earnings report that laid bare the intensifying challenges facing the beauty

Via MarketMinute · February 6, 2026

The digital healthcare landscape faced a harsh reality check on February 6, 2026, as shares of Doximity, Inc. (NYSE: DOCS) plummeted 17% in early trading. Despite reporting fiscal third-quarter results that surpassed analyst estimates for both revenue and earnings, the professional network for physicians issued a tepid outlook for the

Via MarketMinute · February 6, 2026

SAN DIEGO — Shares of Qualcomm Inc. (NASDAQ: QCOM) experienced a sharp sell-off this week, falling over 10% after the semiconductor giant issued a sobering second-quarter forecast that overshadowed record-breaking first-quarter results. Despite surpassing analyst expectations for the end of 2025, management warned that a structural "memory crunch" is beginning to

Via MarketMinute · February 6, 2026

The digital landscape witnessed a seismic shift on February 6, 2026, as shares of Roblox (NYSE: RBLX) soared more than 10% in early trading following a blockbuster fourth-quarter earnings report. The company, once viewed primarily as a playground for children, proved to Wall Street that its transition into a multi-generational

Via MarketMinute · February 6, 2026

BILL Holdings (NYSE: BILL) saw its shares skyrocket by more than 14% in early trading on February 6, 2026, as investors cheered a robust second-quarter fiscal 2026 earnings report that exceeded expectations across every major financial metric. The San Jose-based financial automation leader delivered a "beat and raise" quarter, characterized

Via MarketMinute · February 6, 2026

In a dramatic reversal of fortune for the digital asset sector, MicroStrategy Inc. (NASDAQ: MSTR) spearheaded a massive rally on the Nasdaq today, February 6, 2026, with its stock price surging 25%. The leap comes as Bitcoin (BTC) staged a historic "V-shaped" recovery, rebounding from a harrowing intraday low of

Via MarketMinute · February 6, 2026

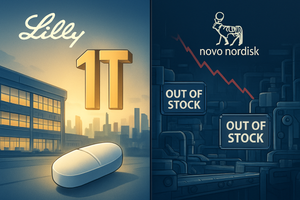

Eli Lilly and Company (NYSE: LLY) has officially entered the "trillion-dollar club" with a roar, issuing a blockbuster financial guidance for 2026 that projects revenue between $80 billion and $83 billion. The announcement, made during the company’s early February earnings call, marks a historic turning point in the pharmaceutical

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through Silicon Valley and Wall Street alike, Alphabet Inc. (NASDAQ: GOOGL) has unveiled a staggering capital expenditure outlook for 2026, signaling its intent to lead the next era of computing at any cost. Following its Q4 2025 earnings report, the tech giant announced

Via MarketMinute · February 6, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026

The global financial landscape was upended this week following the announcement that Kevin Warsh, a former Federal Reserve Governor known for his skeptical stance on unconventional monetary policy, has been nominated to succeed Jerome Powell as the next Chair of the Federal Reserve. The news, which broke on the morning

Via MarketMinute · February 6, 2026

The managed care sector was sent into a tailspin on Friday as Molina Healthcare (NYSE: MOH) saw its market capitalization evaporate in a historic sell-off. Shares of the Long Beach-based insurer plummeted 28% to $127.16 after the company issued a 2026 earnings forecast that was not just a miss,

Via MarketMinute · February 6, 2026

In a breathtaking display of the digital asset market's enduring volatility, Bitcoin (BTC) staged a massive "V-shaped" recovery on February 6, 2026, surging back above the $70,000 psychological threshold. This rally followed a harrowing overnight session where the world's largest cryptocurrency plummeted to an intraday low of $60,008.

Via MarketMinute · February 6, 2026

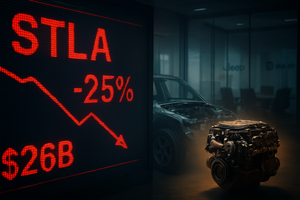

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

OMAHA, NE and ATLANTA, GA — In a move that has sent shockwaves through the global logistics industry and ignited a firestorm of regulatory scrutiny, Union Pacific (NYSE:UNP) and Norfolk Southern (NYSE:NSC) are aggressively pursuing a historic $85 billion merger. The deal, which aims to create the first truly

Via MarketMinute · February 6, 2026

SEATTLE — Shares of Amazon.com, Inc. (NASDAQ:AMZN) plummeted more than 5% in early trading on Friday, February 6, 2026, following a fourth-quarter earnings report that showcased record-breaking revenue but also unveiled a staggering $200 billion capital expenditure plan for the coming year. While the tech giant beat analyst expectations

Via MarketMinute · February 6, 2026

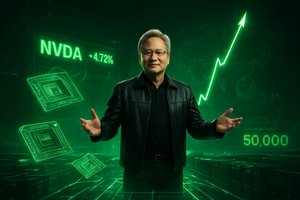

In a historic session for Wall Street, shares of Nvidia (NASDAQ:NVDA) surged more than 8% on Friday, February 6, 2026, breathing new life into the global technology trade. The rally was ignited by a high-stakes television appearance by CEO Jensen Huang, who declared that the demand for artificial intelligence

Via MarketMinute · February 6, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

Biogen Inc. (NASDAQ: BIIB) reported its fourth-quarter and full-year 2025 financial results on February 6, 2026, signaling a definitive shift from a legacy company plagued by patent cliffs to a leaner, growth-oriented neurology powerhouse. Despite a 7% year-over-year revenue decline to $2.28 billion, the company beat Wall Street expectations

Via MarketMinute · February 6, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

MUSCAT, Oman — On February 6, 2026, global financial markets pivoted sharply as indirect negotiations between the United States and Iran resumed in Oman, aiming to de-escalate a year of unprecedented military and economic friction. This "Oman Round" of talks comes on the heels of a historic surge in gold prices

Via MarketMinute · February 6, 2026

In a week defined by high-stakes political theater and a brief but disruptive lapse in federal operations, Washington has managed to pull back from the edge of a total collapse—though only partially. On February 3, 2026, a $1.2 trillion appropriations package was signed into law, ending a four-day

Via MarketMinute · February 6, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The optimistic start to 2026 has been abruptly halted as the S&P 500 index officially turned red for the year during a volatile trading session on February 6, 2026. After a promising January that saw the index climb 1.4%, a brutal three-day rout has wiped out nearly $1

Via MarketMinute · February 6, 2026

The United States labor market, long considered the resilient backbone of the post-pandemic economy, showed significant signs of strain in January 2026. A dual-threat of surging corporate layoffs and a sharp contraction in job openings has sent ripples through the financial markets, challenging the "soft landing" narrative that dominated much

Via MarketMinute · February 6, 2026

The enterprise software sector is currently weathering its most severe valuation crisis in over two decades, as investors aggressively reappraise the future of software-as-a-service (SaaS) in an era dominated by autonomous AI. As of February 6, 2026, the industry’s average forward price-to-earnings (P/E) ratio has plummeted to roughly

Via MarketMinute · February 6, 2026

In a decisive move that underscores the unexpected resilience of the American economy, the Federal Reserve announced last week it would maintain the federal funds rate in the 3.5% to 3.75% range. This "hawkish hold" marks a pivotal pause in the easing cycle that dominated late 2025, signaling

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through global financial markets, the nomination of Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve has signaled a dramatic regime shift in American monetary policy. Announced on January 30, 2026, the decision marks the end of the "Powell

Via MarketMinute · February 6, 2026

Advanced Micro Devices (NASDAQ: AMD) has delivered a resounding statement to the semiconductor industry, reporting fourth-quarter 2025 earnings that shattered analyst expectations and signaled a massive shift in the landscape of artificial intelligence infrastructure. The chipmaker posted non-GAAP earnings of $1.53 per share, representing a blistering 40% year-over-year jump

Via MarketMinute · February 6, 2026

In a dramatic shift for the consumer staples sector, The Hershey Company (NYSE: HSY) saw its stock price climb more than 9% following the release of its fourth-quarter 2025 earnings report. The confectionery giant not only shattered analyst expectations for both profit and revenue but also provided a surprisingly robust

Via MarketMinute · February 6, 2026

The long-standing duopoly of the weight-loss drug market faced its most significant challenge yet this week as Hims & Hers Health, Inc. (NYSE: HIMS) announced a breakthrough $49 compounded oral semaglutide pill. The move, aimed directly at the market share of pharmaceutical titans Eli Lilly and Company (NYSE: LLY) and Novo

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

[ one to two paragraphs describing the current event and its immediate implications ]

The American industrial landscape is currently witnessing its most significant upheaval in decades as Union Pacific (NYSE: UNP) continues its aggressive $85 billion pursuit of Norfolk Southern (NYSE: NSC). This historic bid, which aims to create the first

Via MarketMinute · February 6, 2026

In the high-stakes arena of Silicon Valley, the honeymoon period for artificial intelligence is officially over. As Alphabet Inc. (NASDAQ: GOOGL) steps into the spotlight for its latest earnings cycle on February 6, 2026, the tech giant finds itself at a precarious crossroads. While the company continues to mint billions

Via MarketMinute · February 6, 2026

Amazon.com Inc. (NASDAQ: AMZN) shares suffered their steepest one-day decline in nearly two years on Friday, February 6, 2026, after the e-commerce and cloud titan unveiled a capital expenditure (capex) forecast that stunned even the most aggressive Wall Street analysts. Despite reporting record-breaking revenue of $213.4 billion for

Via MarketMinute · February 6, 2026

On January 28, 2026, Microsoft Corp. (NASDAQ: MSFT) released its calendar year-end financial results, delivering a performance that, on paper, should have been a triumph. The tech giant reported record quarterly revenue of $81.3 billion and earnings per share of $4.14, handily beating analyst estimates. However, the market’

Via MarketMinute · February 6, 2026

In a definitive signal that the investment banking winter has not only thawed but shifted into a high-intensity burn, Evercore (NYSE: EVR) reported a staggering Q4 2025 earnings beat this week, posting an adjusted earnings per share (EPS) of $5.13. The result, which blew past analyst estimates of $4.

Via MarketMinute · February 6, 2026

As of early February 2026, the long-predicted "Great Rotation" in the financial markets has moved from a theoretical forecast to a dominant reality. After years of a top-heavy market driven by a handful of technology titans, the tide has finally turned. The first five weeks of 2026 have seen the

Via MarketMinute · February 6, 2026

As of early February 2026, the global financial markets are witnessing a paradigm shift that many analysts are calling the "Security Supercycle." What began as a reactive surge in defense spending following the 2022 invasion of Ukraine has evolved into a structural, multi-decade rearmament phase. This "deterrence economy" has pushed

Via MarketMinute · February 6, 2026

As of February 6, 2026, the corporate landscape in London is being redefined not by ambitious mergers or technological breakthroughs, but by a massive, sustained return of capital to shareholders. Yesterday’s twin announcements from Shell (LSE: SHEL) and Vodafone (LSE: VOD)—confirming billions in fresh share buybacks—mark a

Via MarketMinute · February 6, 2026

In a staggering reversal that has stunned global commodity markets, gold prices have retreated sharply from their historic record highs, recording a massive 11% correction over the past week. The sell-off, which culminated in a violent "flash crash" on January 30, 2026, saw spot gold tumble from a peak of

Via MarketMinute · February 6, 2026

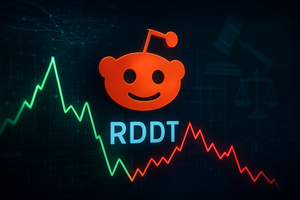

The paradox of the "front page of the internet" was on full display this week as Reddit, Inc. (NYSE: RDDT) reported fourth-quarter 2025 financial results that, on paper, should have sent shares soaring. The company delivered a significant beat on both top and bottom lines, fueled by a surge in

Via MarketMinute · February 6, 2026

As the dust settles on the 2025 holiday shopping season, Apple Inc. (NASDAQ:AAPL) has once again silenced skeptics with a blockbuster fiscal first-quarter report that underscores the company’s unparalleled market resilience. Defying fears of a saturated global smartphone market and geopolitical headwinds, the tech giant posted record-breaking revenue

Via MarketMinute · February 6, 2026

Uber Technologies (NYSE: UBER) reported its fourth-quarter and full-year 2025 earnings this week, unveiling a financial performance that underscores its absolute dominance in the global mobility and delivery sectors. While the company achieved record-breaking revenue and user growth, the market’s reaction remained lukewarm, as investors balanced impressive operational metrics

Via MarketMinute · February 6, 2026

In late January 2026, the artificial intelligence gold rush hit a structural wall of skepticism. Microsoft (Nasdaq: MSFT), the company that kicked off the generative AI era with its investment in OpenAI, reported a set of quarterly earnings that has left Wall Street divided. While the tech giant posted record

Via MarketMinute · February 6, 2026

In a dramatic shift for global equity markets, the first week of February 2026 has witnessed a sharp technical breakdown as long-standing momentum gauges for the S&P 500 (NYSE:SPY) turned negative. The bullish fervor that propelled the market to historic highs throughout 2025 has collided with a wall

Via MarketMinute · February 6, 2026

The global mergers and acquisitions (M&A) landscape has officially shifted from a period of high-rate hibernation to an era of "megadeal" dominance. On February 4, 2026, Evercore (NYSE:EVR) reported record-breaking fourth-quarter earnings that not only shattered analyst expectations but also served as a definitive bellwether for a broader

Via MarketMinute · February 6, 2026

The four-day partial government shutdown that began at midnight on January 30, 2026, has officially come to a close, yet the ripples of the gridlock continue to disturb the waters of Wall Street. While the signing of a short-term funding bill on February 3 restored operations for the Department of

Via MarketMinute · February 6, 2026

WASHINGTON, D.C. — In a week that has sent tremors through the global financial architecture, Treasury Secretary Scott Bessent appeared before the Senate Banking Committee on February 5, 2026, delivering testimony that many economists believe signals a fundamental shift in the relationship between the White House and the Federal Reserve.

Via MarketMinute · February 6, 2026

The nomination of Kevin Warsh to lead the Federal Reserve has ignited a firestorm in Washington, pitting the White House against a group of determined Republican senators and paralyzing the world’s most powerful central bank. As of February 6, 2026, the transition of power at the Fed—intended by

Via MarketMinute · February 6, 2026

The global race for obesity market dominance reached a historic turning point this week as Eli Lilly and Company (NYSE: LLY) officially crossed the $1 trillion market capitalization threshold, cementing its status as the world’s most valuable healthcare entity. The milestone follows a stellar 2026 guidance report that projected

Via MarketMinute · February 6, 2026

As the dust settles on the fourth-quarter earnings season of 2025, a clear divergence has emerged among the "Magnificent Seven" technology giants. While much of Silicon Valley is grappling with the staggering costs of the artificial intelligence arms race, Meta Platforms Inc. (NASDAQ: META) has defied the skeptics. By successfully

Via MarketMinute · February 6, 2026

The financial world was sent into a tailspin this week as a massive market rout wiped out approximately $285 billion in market capitalization across the software, financial services, and asset management sectors. The catalyst for the sell-off, which analysts are calling the "SaaSpocalypse," was the release of a suite of

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through both Silicon Valley and Wall Street, Elon Musk announced on February 2, 2026, the formal merger of his aerospace giant, SpaceX, and his artificial intelligence venture, xAI. The deal values the combined entity at a staggering $1.25 trillion, creating the world’

Via MarketMinute · February 6, 2026

The tech world was sent into a tailspin this week as Amazon.com Inc. (NASDAQ: AMZN) unveiled a staggering $200 billion capital expenditure guidance for 2026, marking the largest single-year investment commitment by any corporation in history. While the retail and cloud giant reported record-breaking quarterly revenue and a significant

Via MarketMinute · February 6, 2026

In a stark illustration of the "priced for perfection" era of high-tech investing, Advanced Micro Devices (NASDAQ: AMD) has found itself at the center of a confusing financial whirlwind. On February 3, 2026, the semiconductor giant reported record-breaking fourth-quarter results for 2025, with CEO Dr. Lisa Su describing the demand

Via MarketMinute · February 6, 2026

The technology sector is currently enduring its most violent repricing since the 2022 interest rate shocks, as a wave of selling has sent the Nasdaq 100 (NASDAQ:QQQ) to levels not seen since mid-November 2025. This "February Rout," which has wiped nearly $1 trillion in market value off the board

Via MarketMinute · February 6, 2026

As of February 6, 2026, the United States labor market appears to have entered a new phase of equilibrium, characterized by the Federal Reserve as a "low-hire, low-fire" environment. Despite a partial government shutdown that has indefinitely delayed the release of the official January Employment Situation report, private sector data

Via MarketMinute · February 6, 2026

As the first quarter of 2026 unfolds, the financial markets are navigating a paradoxical landscape defined by aggressive fiscal expansion and unprecedented geopolitical friction. While the "Stampeding Bull" of 2024 and 2025 was driven by a frenzy of price-to-earnings expansion and artificial intelligence (AI) hype, a new narrative has taken

Via MarketMinute · February 6, 2026

As of February 6, 2026, the North American energy landscape has reached a historic inflection point. The frantic merger and acquisition (M&A) wave that gripped the industry between 2023 and 2025 has largely transitioned into an intensive integration phase, fundamentally reshaping the sector into a more concentrated market dominated

Via MarketMinute · February 6, 2026

As of February 6, 2026, the technology sector is witnessing a paradoxical shift in the mergers and acquisitions (M&A) landscape. While the sheer number of transactions has hit an eight-year plateau, the total capital being deployed is reaching historic highs. This "K-shaped" recovery in deal-making is almost entirely driven

Via MarketMinute · February 6, 2026

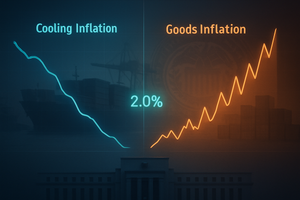

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

As of February 6, 2026, the American consumer landscape has fractured into two distinct realities, creating a "K-shaped" economic environment that is redefining the retail and service sectors. While a record-breaking stock market and robust asset growth have propelled affluent households to new heights of discretionary spending, lower-income Americans are

Via MarketMinute · February 6, 2026

The global energy landscape has undergone a seismic shift, culminating in a staggering 98% year-over-year surge in deal value for the Power and Utilities (P&U) sector as of early 2026. According to the latest market data from January 2026, the sector has transitioned from a traditional defensive haven into

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is being reshaped by an unprecedented "wall of capital." After nearly two years of stagnation caused by valuation gaps and high borrowing costs, the private equity industry has entered a transformative period of deployment. With a record-shattering $3.2 trillion in

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is characterized by a high-stakes tug-of-war between record-breaking corporate earnings and extreme market concentration. Major Wall Street institutions, led by JPMorgan Chase & Co. (NYSE: JPM), have released a series of aggressive 2026 outlooks that forecast a robust 13% to 15% earnings

Via MarketMinute · February 6, 2026

The life sciences sector has entered 2026 in the midst of a historic transformation, as deal volume and value surged by a staggering 82% over the past year. This "Great Rebound," fueled by a record-shattering $240 billion in total M&A investment in 2025, represents a fundamental shift in how

Via MarketMinute · February 6, 2026

SAN FRANCISCO – As of February 6, 2026, the global financial landscape has shifted into a new, higher gear, defined by what analysts are calling the "AI Capital Expenditure Supercycle." A series of blockbuster reports from leading financial institutions and technology giants has confirmed a staggering reality: global spending on data

Via MarketMinute · February 6, 2026

As of February 6, 2026, the media and entertainment landscape is undergoing a tectonic shift not seen in nearly a decade. The industry has been rocked by the formal announcement and subsequent regulatory scrutiny of Netflix (NASDAQ:NFLX)'s staggering $82.7 billion acquisition of the core film and television

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is still reverberating from a historic tectonic shift that occurred in the final months of last year. In the fourth quarter of 2025, the M&A market witnessed an unprecedented "mega-deal" frenzy, with 22 global transactions valued at over $10 billion

Via MarketMinute · February 6, 2026

The long-awaited "deal drought" has officially broken. As of early February 2026, the American financial landscape is being reshaped by a massive resurgence in corporate deal-making, punctuated by a staggering 111.5% year-over-year increase in transactions valued over $100 million at the close of 2025. This tidal wave of capital

Via MarketMinute · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026