SPDR S&P China ETF (GXC)

103.47

+0.94 (0.92%)

NYSE · Last Trade: Jan 27th, 7:13 PM EST

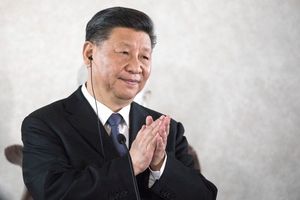

China's fentanyl export cutdown signals easing U.S.–China tensions, boosting optimism for China-focused and emerging-market ETFs.

Via Benzinga · November 10, 2025

China-focused ETFs gain momentum as trade talks and a weaker USD shift investor sentiment. KWEB ETF up 30% YTD. KraneShares sees potential for growth in China's new economy industries and offers thematic funds like KWEB, KARS, and more. Other options include FXI, GXC, and CHIQ. China's policies fuel the trend.

Via Benzinga · August 27, 2025

Via Benzinga · July 3, 2025

On Tues, U.S. markets closed mixed w/ S&P 500 & Nasdaq down due to large-cap tech stocks, while Dow gained. Volatility high, data supported Fed's stance. Asia markets vary, Europe up, commodities steady, U.S. futures and dollar index rise.

Via Benzinga · July 2, 2025

US markets closed higher on Friday with record highs amid trade optimism and Fed rate cuts. Dow up 1%, S&P 500 up 0.54%, Nasdaq up 0.52%.

Via Benzinga · June 30, 2025

U.S. markets up on trade deals and rate cut hopes, but concerns persist. Mixed economic data, Central bank expectations, and geopolitical risks affect performance. Asia and Europe markets mostly lower, commodities mixed, USD weak on trade uncertainty.

Via Benzinga · July 1, 2025

U.S. markets closed higher on Thursday, boosted by easing geopolitical tensions and supportive economic data. Asia and Europe markets also saw gains.

Via Benzinga · June 27, 2025

US markets closed mixed on Wednesday, tech shares lifted Nasdaq while S&P 500 remained flat. Fed Chair Powell reiterated wait-and-see approach. Asian markets mostly up, European markets also positive with oil prices steady.

Via Benzinga · June 26, 2025

Positive market close as investors react to Israel-Iran ceasefire and await Fed signals. Tech shares lead rally, energy stocks slip. US futures mixed.

Via Benzinga · June 25, 2025

US stocks mixed amid Iran tensions and inflation concerns, S&P dips, Nasdaq gains. Asia markets down, Europe declines. Oil up on Iran strike fears.

Via Benzinga · June 23, 2025

U.S. markets closed lower on Tuesday due to geopolitical tensions, with energy & defense stocks rising. Asia markets mixed, Europe flat, oil prices dip.

Via Benzinga · June 18, 2025

This would mark the third time that Trump has put off enforcing a federal law requiring TikTok’s sale or ban, which was originally supposed take affect the day before his January inauguration.

Via Stocktwits · June 17, 2025

U.S. markets end higher as tensions ease between Israel and Iran, while all eyes remain on Fed's rate decision. Asian markets mostly down.

Via Benzinga · June 17, 2025

Market summary: US markets closed lower on Friday due to rising Iran-Israel tensions. Most sectors declined but energy stocks rose. Asian, Eurozone, and US futures are up while oil prices dip.

Via Benzinga · June 16, 2025

Via Benzinga · June 11, 2025

Tensions in the Middle East and Trump's threats to Iran are causing uncertainty in global markets, leading to a shift towards safe-haven assets like gold and crude oil. Asian markets are also feeling the impact, with declines in Japan, Australia, India, China, and Hong Kong. In Europe, the STOXX 50, DAX, CAC 40, and FTSE 100 are all down. Oil prices surged over 7% after the strike and fears of supply disruption, while natural gas, gold, silver, and copper also saw price movements. U.S. futures are down over 1%, led by declines in the Dow Jones and Nasdaq 100. The dollar has gained against major currencies as investors seek safe havens.

Via Benzinga · June 13, 2025

US markets closed mixed, with modest gains in S&P and Nasdaq while Dow was flat due to losses in McDonald's and Travelers. Economic data showed increase in wholesale inventories and drop in inflation expectations. Asian markets mostly up, Europe mostly down.

Via Benzinga · June 10, 2025

Stocks end lower on Middle East tensions and skepticism over US-China trade deal, with most sectors declining. Economic data shows lower than expected inflation. Asia markets also down, led by losses in Japan and Australia. European stocks also lower, while oil and metal prices rise due to safe-haven demand. US futures and dollar decline.

Via Benzinga · June 12, 2025

US markets closed in green on Friday, boosted by strong jobs report and renewed trade talks. Asian markets rally, record highs hit globally.

Via Benzinga · June 9, 2025

Via Benzinga · June 6, 2025

US markets closed mixed as weak data and trade tensions weighed. S&P 500 flat, Nasdaq up, Dow down. Asia and Europe markets mostly up. Oil steady.

Via Benzinga · June 5, 2025

Via Benzinga · June 4, 2025

U.S. markets close higher despite Trump's tariff threats. ISM PMI falls, construction spending drops. Dow up 0.08%, S&P 500 gains 0.41%, Nasdaq rises 0.67%.

Via Benzinga · June 3, 2025

US markets closed mixed on Friday, with S&P 500 flat but posting strong monthly gain. Asian markets down as oil prices rise and USD weakens.

Via Benzinga · June 2, 2025