What a brutal six months it’s been for USANA. The stock has dropped 31.7% and now trades at a new 52-week low of $27.43, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy USANA, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about USANA. Here are three reasons why there are better opportunities than USNA and a stock we'd rather own.

Why Is USANA Not Exciting?

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

1. Revenue Spiraling Downwards

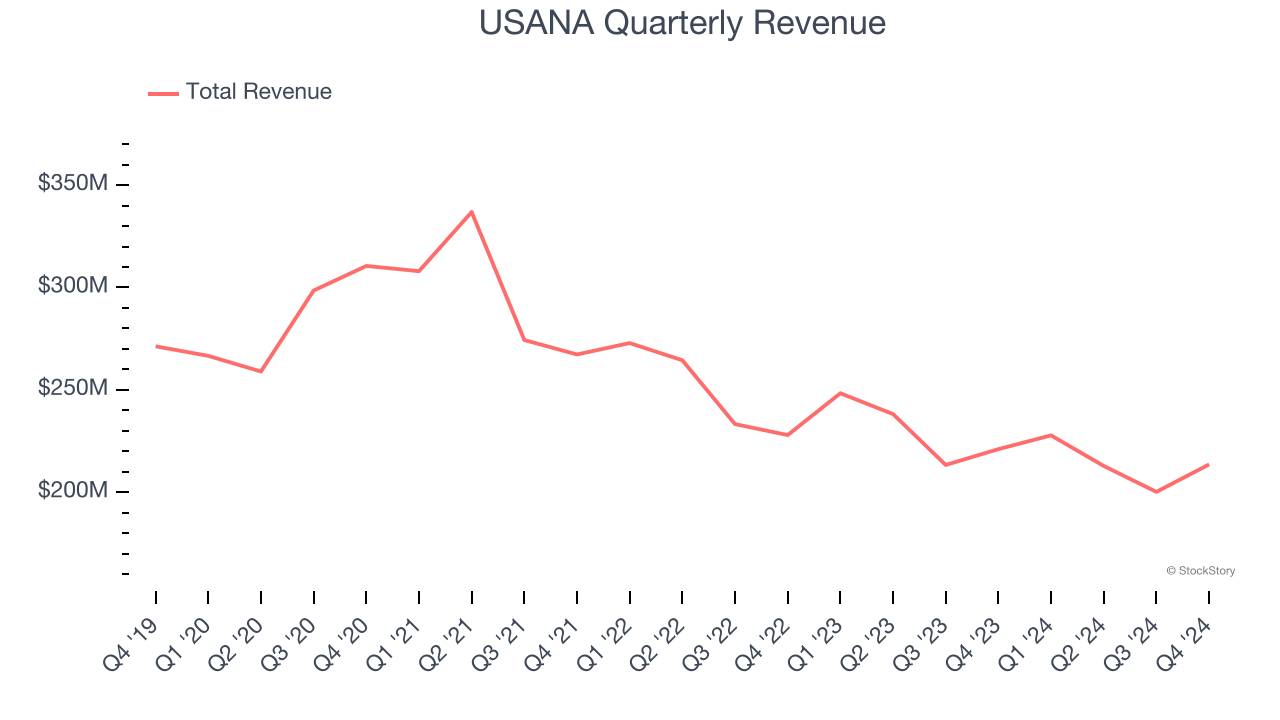

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. USANA struggled to consistently generate demand over the last three years as its sales dropped at a 10.4% annual rate. This wasn’t a great result and signals it’s a lower quality business.

2. Fewer Distribution Channels Limit its Ceiling

With $854.5 million in revenue over the past 12 months, USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. EPS Trending Down

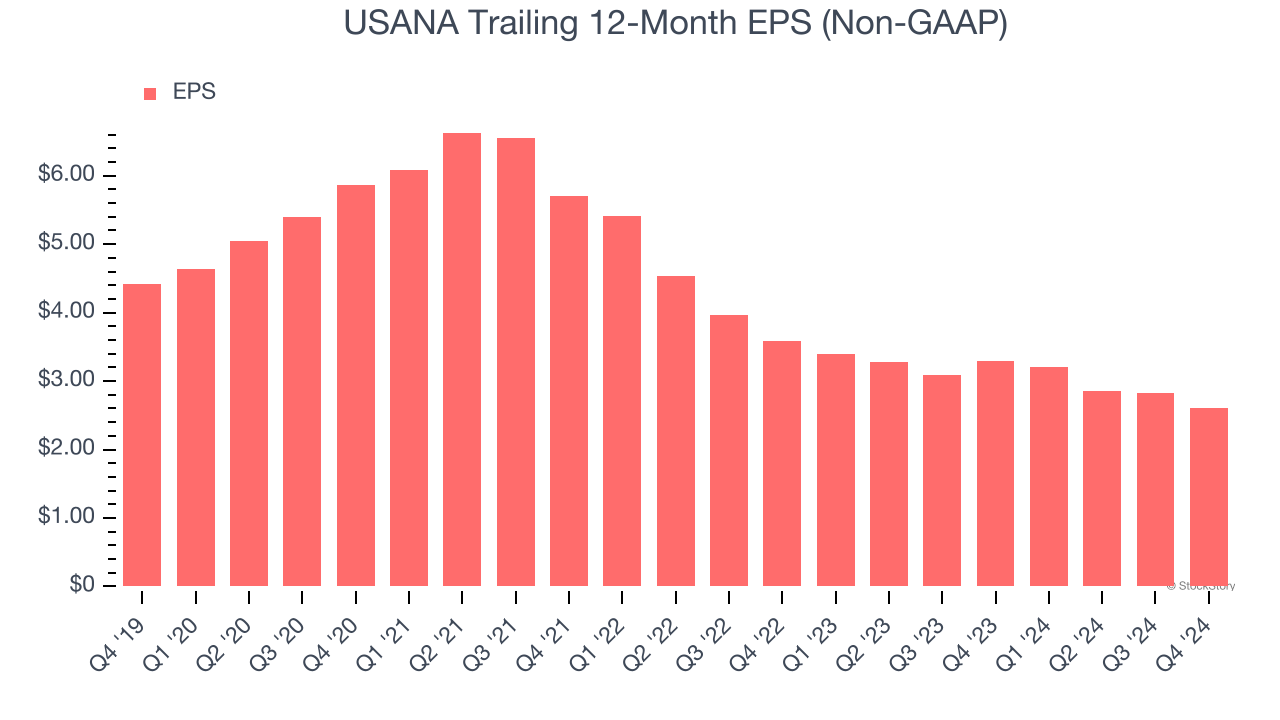

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for USANA, its EPS declined by 23.1% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

USANA’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 9.7× forward price-to-earnings (or $27.43 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of USANA

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.