BankUnited’s 26% return over the past six months has outpaced the S&P 500 by 11.6%, and its stock price has climbed to $43.89 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in BankUnited, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think BankUnited Will Underperform?

We’re happy investors have made money, but we don't have much confidence in BankUnited. Here are three reasons we avoid BKU and a stock we'd rather own.

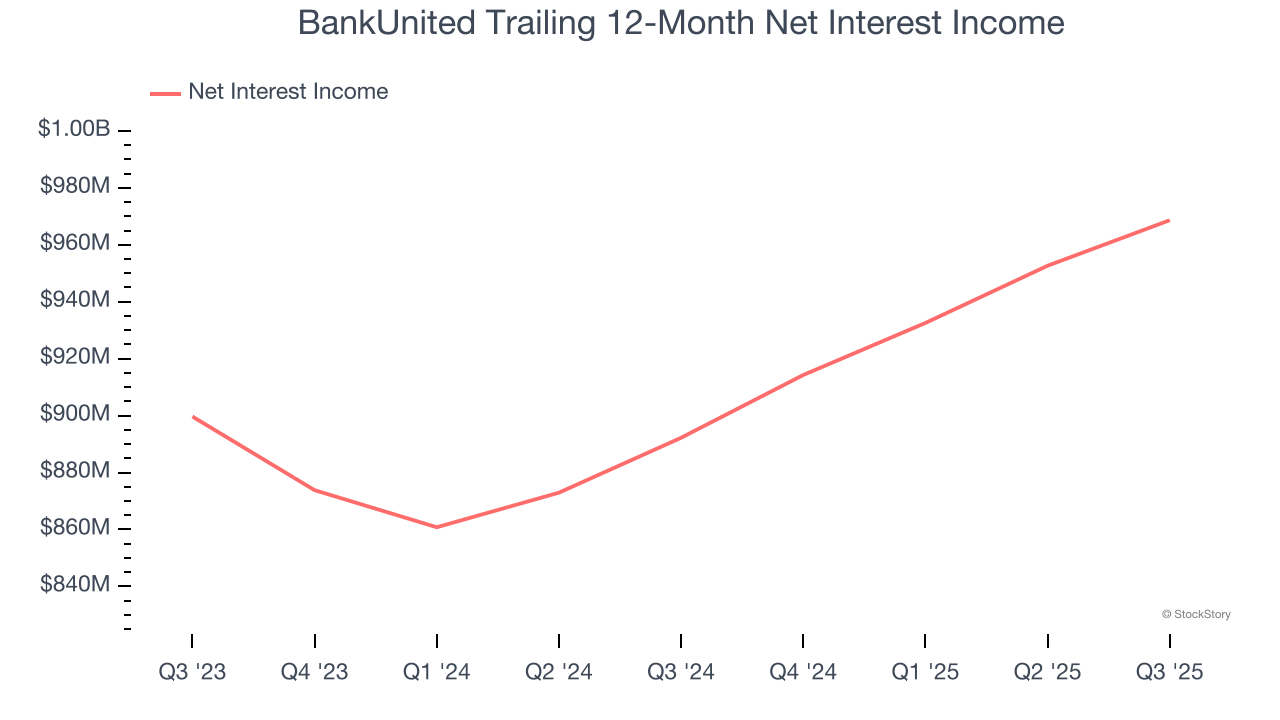

1. Net Interest Income Points to Soft Demand

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

BankUnited’s net interest income has grown at a 5.4% annualized rate over the last five years, much worse than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

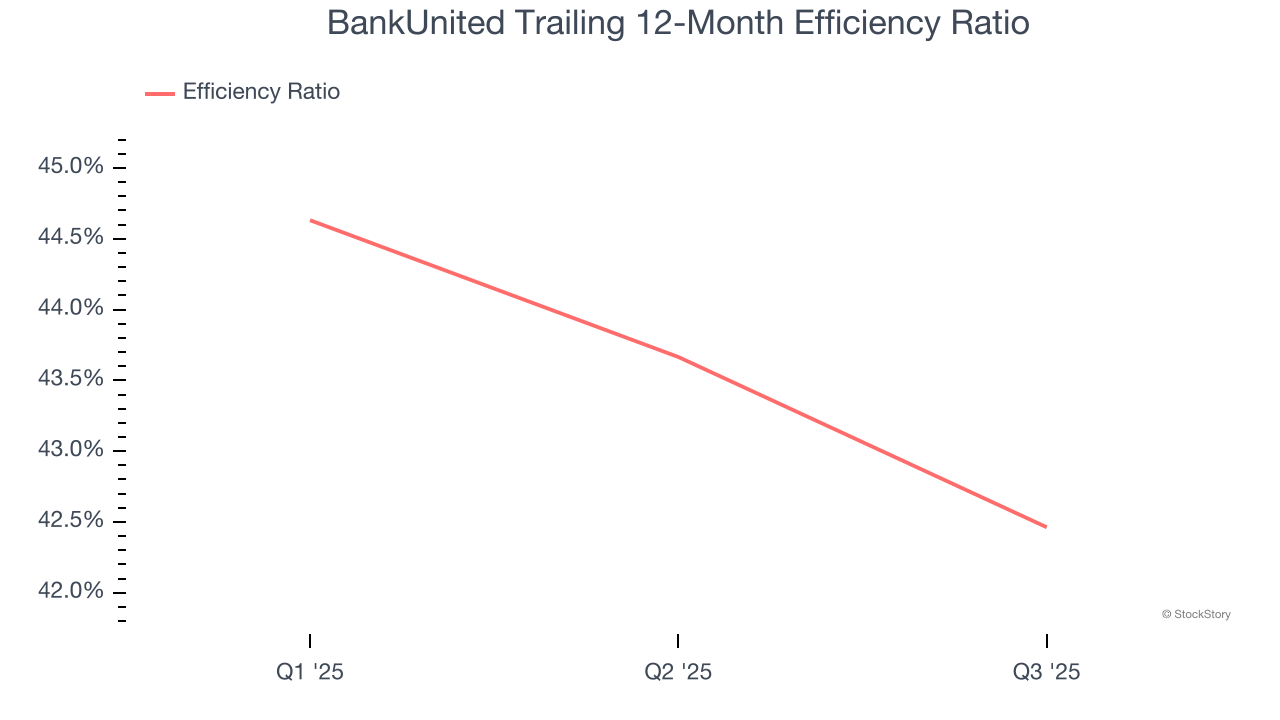

2. Efficiency Ratio Expected to Falter

The underlying profitability of top-line growth determines the actual bottom-line impact. Banking institutions measure this dynamic using the efficiency ratio, which is calculated by dividing non-interest expenses like personnel, facilities, technology, and marketing by total revenue.

Markets emphasize efficiency ratio trends over static measurements, recognizing that revenue compositions drive different expense bases. Lower efficiency ratios signal superior performance by indicating that banks are controlling costs effectively relative to their income.

For the next 12 months, Wall Street expects BankUnited to become less profitable as it anticipates an efficiency ratio of 60.5% compared to 42.5% over the past year.

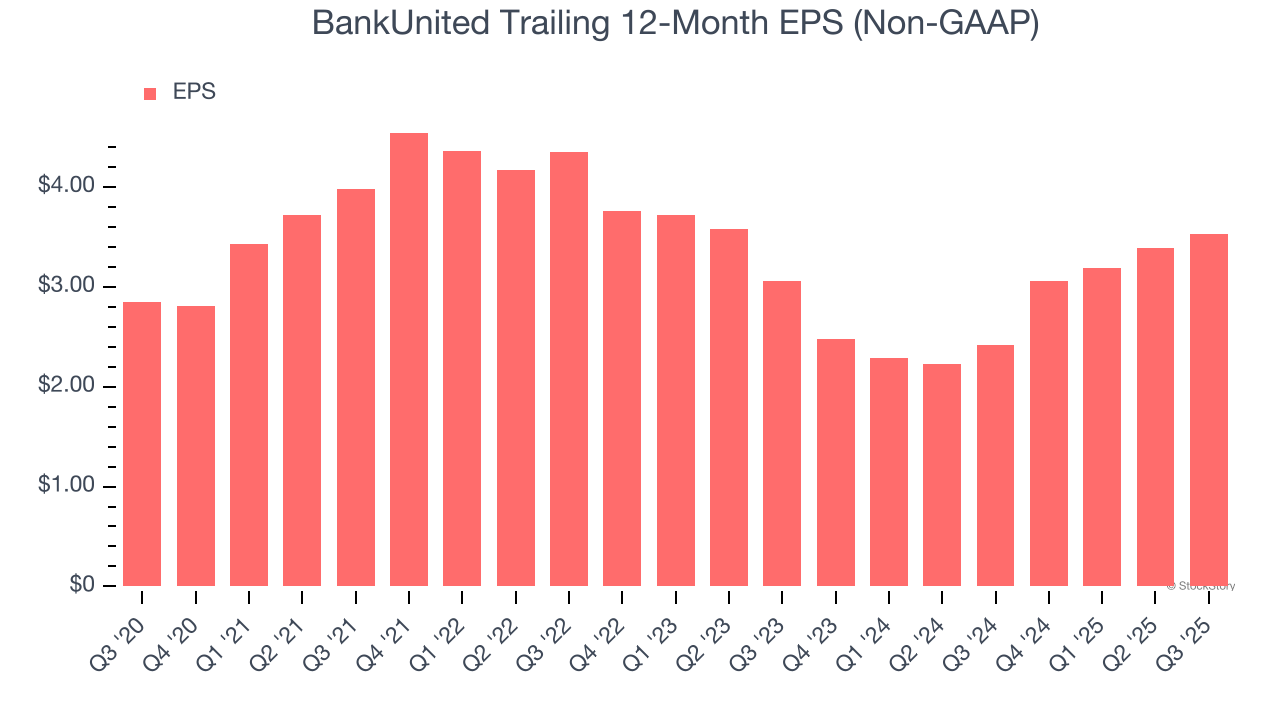

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

BankUnited’s weak 4.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

BankUnited doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 1.1× forward P/B (or $43.89 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than BankUnited

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.